Crypto Art and the law

Decrypting Crypto Art: Is it a fad or is it here to stay?

Sharon Givoni Consulting Copyright, Intellectual Property, Trade marks

Since its very beginning, the rise of new digital technologies such as blockchain have made all of us sit up in our seats and wonder – what does this mean for us and our daily lives? Nowhere is this more true than the recent explosion of Non-Fungible Tokens (or ‘NFTs’) in the digital art world. In fact, a twelve year old boy from London reportedly made an approximate $540,000 AUD during his school holidays after selling his “Weird Whales” images.

So, are NFT’s here to stay or just a case of the emperor’s new clothes?

Intellectual Property lawyer Sharon Givoni regularly receives questions from artists such as photographers about the future of the industry and what effects the rise of NFTs will have in both the short and long term.

Whether good or bad, one thing is certain: NFT’s are creating big waves in the creatives industry and keen collectors have caught on.

In the words of Melbourne-based Creative Director and artist Rhett Dashwood: “NFT technology opened up a whole new world of possibilities on a global scale that just wasn’t previously possible. I think the impact of NFTs on the traditional art world will be akin to the impact the internet had on newspapers.”

First Things First

The first thing to remember is that an NFT is a unique digital token or “certificate” that cannot be interchanged with anything. Being one of a kind, an NFT allows for artwork to be tokenised to create a certificate of ownership that can be bought and sold. The buyer therefore receives a blockchain-based certificate which showcases every previous owner including the date and time of each transaction.

This means that artists can “tokenise” their work by creating such a digital certificate of ownership.

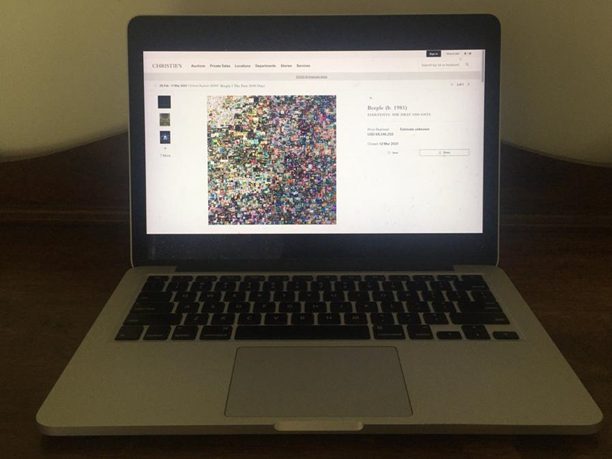

Consider the most notorious NFTs sold to date is “Everydays: The First 5,000 Days”, which was bought for an eye-watering amount of $69.3 million USD.

Frequently Asked Questions

Question (Q): Can you tell us a little about how you got into this area?

Sharon Givoni (SG): In my legal practice, I have acted for many creative businesses and artists, including street artists and graphic designers, as well as NFT artist management.

Q: What advice would you give artists who want to get involved with NFTs?

SG: Even though there are legal implications, there are also financial considerations that lawyers cannot advise on. After all, cryptocurrency is a financial instrument and just like any investment, selling an NFT can incur Capital Gains Tax, and people will need to be aware how this might financially impact upon them.

Q: In your opinion, has the pandemic impacted on – or even fuelling – this new NFT craze?

SG: The impact of the pandemic has meant a lot of us have turned to the internet for entertainment and comfort. E-commerce, gambling apps and cryptocurrency have assumed a new importance. So yes, I would say tokenising art is part of the pandemic-fuelled crypto investor revolution. COVID-19 has triggered the e-commerce turning point and tentacles have reached far to tokenised art.

Q: So how do NFTs work?

SG: NFTs refer to blockchain-based digital tokens that are designed to function as representations of real-world or digital assets. An NFT cannot be duplicated since each token has identifying information that is completely unique. This is what makes it so attractive. Once you own it – it’s yours.

There are several NFT exchanges in the art space. In my view, the benefits are that a blockchain network can track orders, payments, accounts, production and much more. This means that for the artist, intellectual property is guaranteed. Further, artists can now get full visibility because it records sales between parties in a transparent, verifiable and permanent manner. Financial advisors, lawyers and art agents also have something to gain.

Australian artist Rhett Dashwood, or ‘Mankind’, has been selling his street art as NFTs.

His most iconic works include his series of surrealist forests, such as that pictured above

Q: I’m confused – if you don’t own copyright when you purchase an NFT, what do you get?

SG: Artists have asked me that in my legal practice time and time again. Effectively, an NFT gives someone a certificate stating that the owner owns that image or photo or artwork. However, even after the NFT is sold to someone else, the artist will usually retain copyright.

The artist benefits as they usually get to keep their work, and the purchaser or investor also benefits because the ownership of the tokens are fixed and secured without any risk of them ever being destroyed, replicated or stolen (you can’t fix tokens!).

Another way to think of an NFT is having a receipt to verify that you have the piece of art, but not having the art itself. Analogies have been made along the lines of having a Certificate of Title, rather than the house itself. It’s the receipt you have to prove ownership, but some have cynically described it as a “bragging right”.

Q: Wait – tangible and intangible? What does that mean?

SG: I always make a distinction between tangible and intangible. Because NFTs are digital in nature, they are always intangible. For instance, a common example I give my clients is that of a painting. The painting itself is a physical object and is therefore tangible. Meanwhile, the exclusive rights provided by copyright laws are intangible.

The irony is that even though one is seen and touched and the other isn’t, in this current pandemic bubble, the intangible can sometimes be even more valuable than something you can hang up on the wall!

It is part of series of the CryptoPunk avatar collectables, some of which are very rare.

The CryptoPunks are made by the studio Larva Labs, consisting of Canadian software developers Matt Hall and John Watkinson (Website at: https://www.larvalabs.com/cryptopunks)

Q: What are resale royalty rights, and do NFTs operate in the same way?

SG: After the copyright amendments, Resale Royalty Rights are made pursuant to the Copyright Act.

Under these Resale Royalty Rights, which became active in 2010, artists have been able to collect royalties on certain resales of their work though the Copyright Agency.

The scheme requires the seller, or the seller’s agent, to report all commercial resales for $1,000 or more, whether or not a royalty is payable. The Agency has managed royalties for thousands of Australian artists.

Q: What is a NFT exchange platform and can you give us some examples?

SG: An NFT exchange is a platform through which people can create, buy and sell NFTs, similar to share trading platforms. They include: Open Sea (being one of the largest), Binance, NFT Marketplace, ZORA, Nifty Gateway and Rarible, to name a few.

Q: Who are some of the most famous NFT artists in Australia?

SG: The name Lushsux immediately comes to mind. He basically paints memes through street art, and is known for his humorous and provocative subject matters. A bit like Banksy, he prefers to be anonymous and it is rumoured he has made the equivalent of over $3 million dollars of NFT sales.

Q: Given you do a lot of work in this area, have you noticed any trends?

SG: While this is a great generalisation, a lot of NFT’s I have seen are very unique, innovative and original – particularly the digital art. I have seen a lot of memes, surrealist dreamscapes, and fantastical scenes. There seems to be no rules, coupled with a high trend-turnover.

Available to buy as an NFT:

https://knownorigin.io/jasminemansbridge

Q: Why do you think some NFTs have attracted such a high price?

SG: Traditional works of art such as paintings are valuable precisely because they are one of a kind. In contrast, digital files can be easily and endlessly duplicated. However, NFTs introduce something new altogether: namely that artwork can be “tokenised” to create a digital certificate of ownership that can be bought and sold.

Certainly the high prices of some NFTs have been a bit of a head-scratcher for some. I believe it is somewhat due to the pandemic-fuelled crypto investor revolution, and for now they’re just “the thing”.

Q: So are you saying NFTs are just “a thing” that’s going to pass?

SG: At first, I thought it was just a fad, but now I realise the value of NFTs. The reality is, not anyone can just whip up an NFT and command a high price for it. The NFT art that holds high value will usually have a fan base of admirers. For example, Beeple’s Instagram was extremely popular before he made his $69 million USD NFT sale. At the time of writing, Beeple has 2.2 million followers on Instagram.

Another perspective people don’t talk about enough is how NFTs have really benefited artists. People should always consider that when buying NFTs, they are supporting artists – and that is never a bad thing, right?

Q: Can you think of a specific example where NFTs have helped an artist?

SG: One that immediately comes to mind is the Canadian photographer by the name of Cath Simard. Initially, she shared a photograph of a road on a Hawaiian island on her Instagram account. When it went viral, she tried to stop the widespread use of her photo all over the internet, none of which credited her as the owner.

Ultimately, after tirelessly tracking down accounts and companies for appropriating her photograph, she minted an NFT of it for approximately $300,000 USD (approximately $415,400 AUD). Now it’s free for anyone to use – and the photograph below speaks for itself (it really is a stunning shot).

So in a sense, NFTs are offering artists a means to claim back and derive profit from their work.

The photo above caused the #FREEHAWAIIPHOTO to be born.

Q: Do you have any final comments?

SG: NFT art classifies digital artworks in a way that enables artists, graphic designers, photographers, animators and street artists (to name a few) to monetise the fruits of their labour. For the purchaser/collector, they benefit in that they get clear proof of ownership and authorship by the artist.

So personally I would encourage all Australian artists to consider whether NFTs could be relevant to them. The NFT space is something artists are encouraged to explore sooner rather than later, as no one knows when the bubble will burst given the unpredictable nature of new technology. Love it or hate it , there are no signs of them slowing down. In case you can’t already tell, I’m a fan!

USEFUL TERMS MADE SIMPLE

Blockchain – a digital ledger that facilitates the process of recording transactions and tracking assets in a business network.

Copyright – literally means the right to copy (and if you own it, on the flipside, the right to prevent copying). As I always say, copyright protection does not extend to ideas, styles, methods of producing art or formats.

Copyright Agency – you can register for resale royalty rights through this Agency.

Crypto-currency – the broader term used to describe digital currencies which Etherium uses.

Ethereum – a blockchain platform with its own cryptocurrency. It has its own programming language with a decentralized, open-source blockchain with smart contract functionality. Ethereum tokens are called ETHER which can be used to buy and sell goods and services (like Bitcoin).

Intangible – something that is not physical in nature but gives the author or artist the right to secure legal protection by preventing others from reproducing the work.

NFT exchanges – OpenSea, Binance NFT Marketplace, Nifty Gateway and Rarible, to name a few.

Non–fungible token (NFT) – a unique digital token or “certificate” that cannot be interchanged with anything. Being one of a kind, an NFT allows for artwork to be tokenised to create a certificate of ownership that can be bought and sold. The buyer receives this blockchain-based certificate of ownership, which showcases every previous owner including the date and time of every prior transaction.

About the author

Sharon Givoni has been working in the area of copyright for 25 years and can assist with NFTs, copyright, contracts and other legal issues facing photographers. She often presents industry talks and seminars and writes regularly for a number of publications on the intersection between the law and the art and creative industry.

DISCLAIMER: Please note the above article is general in nature and does not constitute legal advice.

Please email us at info@iplegal.com.au if you need legal advice on NFTs and Crypto Art.